- Solutions

-

-

Sub Menu

Solutions

for

-

Lenders

Discover a streamlined approach that helps you attract and keep borrowers.

-

Brokers

Get to close sooner with consistently fast, accurate appraisals.

-

Appraisers

Mitigate risk, gain flexibility, and make your job easier with a strategic partner.

-

Credit Unions

Class Union, a specialized division committed to serving the unique needs of credit union clients.

-

Lenders

-

Right Side Title

Get Started

-

-

- Appraisal Innovation

-

-

Menu Title

Appraisal Innovation

Learning

Sub Menu

-

Digital appraisals

Accelerate appraisals with tech-driven details and quality you can count on.

-

Property Data Collection

Capture every detail of a property with stunning accuracy.

-

AI & appraisals

Power unprecedented appraisal quality with the latest technology.

-

Digital appraisals

-

Right Side Title

Software & Tools

-

-

- Resources & Support

-

-

Menu Title

Resources & Support

Sub Menu

-

Contact us

Ask a question, get support, or join our team. We’re here to help!

-

Resource Center

See the latest industry insights, plus what’s going on at Class.

-

Reconsideration of Value

Submit a request, and receive the service you need to get a fair, accurate value.

-

Appraiser Relations Team

Get personalized support from expert appraisers.

-

Contact us

-

-

- Company

-

-

Menu Title

Class Valuation

Sub Menu

-

About us

See the vision and values that drive us to elevate the appraisal industry.

-

Appraisal offerings

Find a complete list of the appraisal types we offer in all 50 states.

-

Events

Check out what we’re up to and where you can meet up with our team.

-

Newsroom

Read the latest and greatest on Class and the appraisal industry.

-

Careers

Search open positions and discover careers that kick Class.

-

FAQs

Get answers to most-asked questions in the appraisal industry.

-

About us

-

-

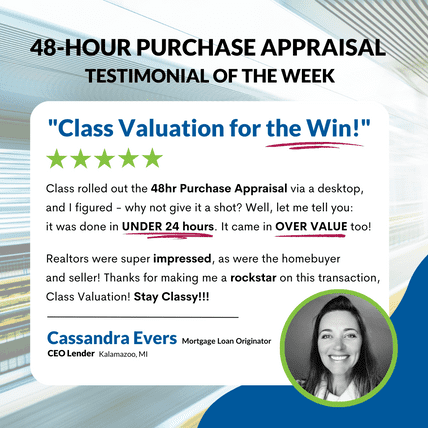

48 Hour Appraisals

Are Here!

Loan Originators Can Win With Radical Speed!

Class Valuation has an exciting new program that delivers 48-hour appraisals. We aim to cut turn times for 70% to 80% of purchase loans to help loan originators win in a competitive market. To accomplish this, we require orders to be submitted as 1004/70 Desktop appraisals instead of traditional appraisals.

Many purchase loans for Freddie Mac® and Fannie Mae®; should qualify for a desktop appraisal as it is now policy and only requires LTV ratios of less than or equal to 90%. However, you must verify eligibility through LPA℠ and DU®. With 48-hour appraisals, borrowers and agents get the confidence they need and an exceptional experience.

Many purchase loans for Freddie Mac® and Fannie Mae®; should qualify for a desktop appraisal as it is now policy and only requires LTV ratios of less than or equal to 90%. However, you must verify eligibility through LPA℠ and DU®. With 48-hour appraisals, borrowers and agents get the confidence they need and an exceptional experience.

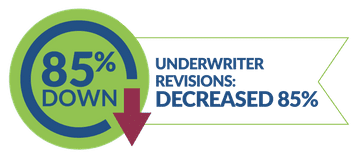

STAY AHEAD WITH UNPRECEDENTED ACCURACY

For 1004/70 Desktop appraisals, Property Fingerprint technology not only improves speed, but improves quality in an effort to remove considerable friction! Underwriter revision rates reduced by 85% and reconsideration of value requests reduced by 65% – this is significant and inspires confidence with your partners and borrowers. This will also help brokers get over the finish line faster with less hassle and stay ahead of the competition.

The Benefits

- Gives borrowers and agents confidence and eases anxiety to create a positive experience.

- Satisfied customers and real estate agents lead to more referral business.

- Class’s desktop solution, Property Fingerprint, does autonomous 3D scanning and provides unprecedented accuracy and speed.

- Provides virtual digital twins of the property to appraisers, so they have a complete view of the property.

- Mitigates bias through a bifurcated inspection and appraisal process.

- Lower revision rates (down 85%) and reconsideration of value requests (down 65%).

Desktop Eligible Transactions

- One-unit property with ADU and PUD units

- Principle residence Purchase transaction (including new construction)

- LTV ratio less than or equal to 90%.

- Loan Product Advisor® or Desktop Underwriter (DU) receives eligible recommendations.

DESKTOP APPRAISAL EVOLUTION

Fannie Mae® and Freddie Mac® introduced Desktop Appraisals as policy for certain purchase transactions in March 2022. There was some initial friction with these products as multiple providers tried to implement solutions quickly without true understanding of the product requirements, leaving their lender partners with a poor experience. Class Valuation — however — has been completing these with extreme success, providing our partners with a premium experience. We are now going nationwide with a 48-hour purchase appraisal program for loans eligible for the Uniform Residential Appraisal Report (1004/70 Desktop)!

Give your borrowers the experience they deserve with Class Valuation!

Give your borrowers the experience they deserve with Class Valuation!

© 2023 All rights reserved. Fannie Mae® DU® and Freddie Mac® LPA℠ and other trademarks appearing herein are trademarks of Fannie Mae® and Freddie Mac® respectively and their affiliates.