As a Loan Officer, you need accurate, timely, and reliable appraisals to ensure smooth loan origination and closing processes. At Class Valuation, we are committed to providing top-tier appraisal services that empower you to close loans faster, mitigate risk, and build stronger relationships with your clients.

Our innovative appraisal solutions ensure that you have the tools and insights needed to close loans effectively and confidently.

Our appraisals are conducted by experienced professionals who understand the importance of accuracy in determining property values, giving you the confidence you need to make informed lending decisions.

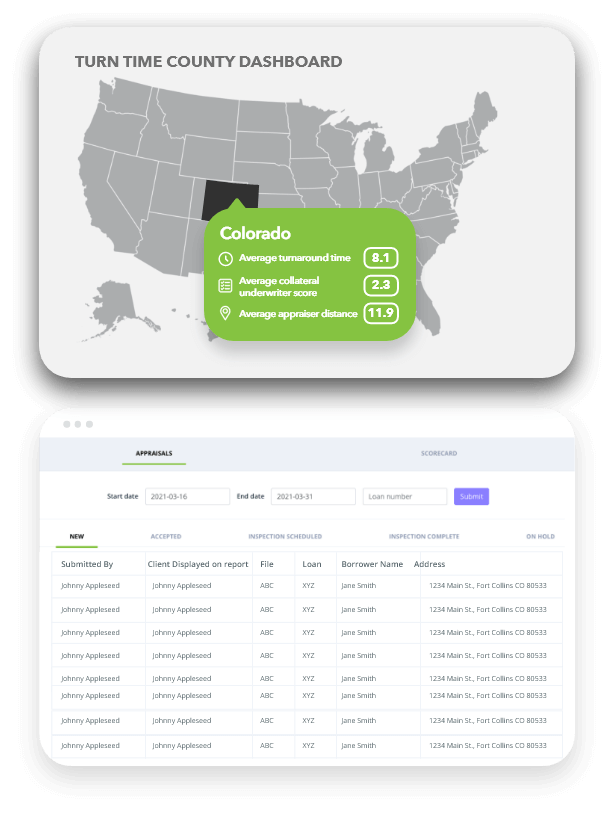

With industry-leading turn times—5 days for traditional appraisals and even quicker results for digital options—we help you maintain momentum in the loan process.

We achieve a 95% on-time completion rate, ensuring that your appraisals are delivered when you need them, keeping your loan timelines on track.

Join our community of lenders & brokers

Check the status of your appraisal

Request your appraisal

At Class Valuation, we provide dedicated Account Executives who understand the unique needs of Loan Officers. They are committed to offering personalized support, ensuring that your appraisals are handled with the utmost care and efficiency.

We offer a wide range of appraisal services designed to meet the specific needs of Loan Officers, including:

At Class Valuation, we offer the most sophisticated digital appraisal products available in the market today. Our cutting-edge technology ensures the highest level of accuracy while significantly decreasing turn times, making your appraisal process smoother and more efficient.

Explore Class Valuation’s comprehensive selection of traditional appraisal products tailored for conventional, FHA, condo, multi-family, manufactured homes, land, and more. We customize appraisals to meet the needs or your organization and risk requirements. With nationwide appraisal coverage and integrated review process, Class Valuation delivers quality without question.

Welcome to Class Valuation’s iCollateral Series, where cutting-edge technology meets industry-leading expertise. Our suite of alternative valuation products – iAVM, iBPO, iAVM+PCR, iEval, iHomeValuator, and iQuant – allows you to define the rules for automated valuation, ensuring that each assessment meets your specific requirements. With advanced cascade management and superior automation, you can achieve quick, accurate, and reliable valuations every time.

Explore how the comprehensive rules and workflow of Class INtelligence delivers quality without question. It’s bot-powered quality assurance that gives us humans more time to focus on other tasks.

Trustworthy and accurate data that supports your lending decisions.

To further support your success, we provide a variety of resources tailored to Loan Officers:

If you have concerns about your appraisal report, you can trust us to guide and support you through the Reconsideration of Value (ROV) process. Our goal is to help you arrive at a fair, accurate value. Before submitting, make sure you read through our ROV support resources to give you the best chance of improving your value.

Choose Class Valuation as your appraisal partner and experience the benefits of fast, accurate, and reliable appraisals. With our dedicated support and industry-leading solutions, you can streamline your loan origination process and better serve your clients.

For any concerns regarding an Appraiser Independence issue please reach out to us via email at air@classvaluation.com or give us a call at 248.955.9506.

For any concerns regarding an Property Data Collector Independence issue please reach out to us via email at pdcir@classvaluation.com or give us a call at 248.509.0231.

ClassValuation © 2025